CURRENCY

BUSINESS OPPORTUNITIES IN bahrain

bahrain

FLAG

BAHRAIN

CAPITAL CITY

MANAMA

ARABIC

Language

Population

17.65 LAKHS

Country

Calling Code

+973

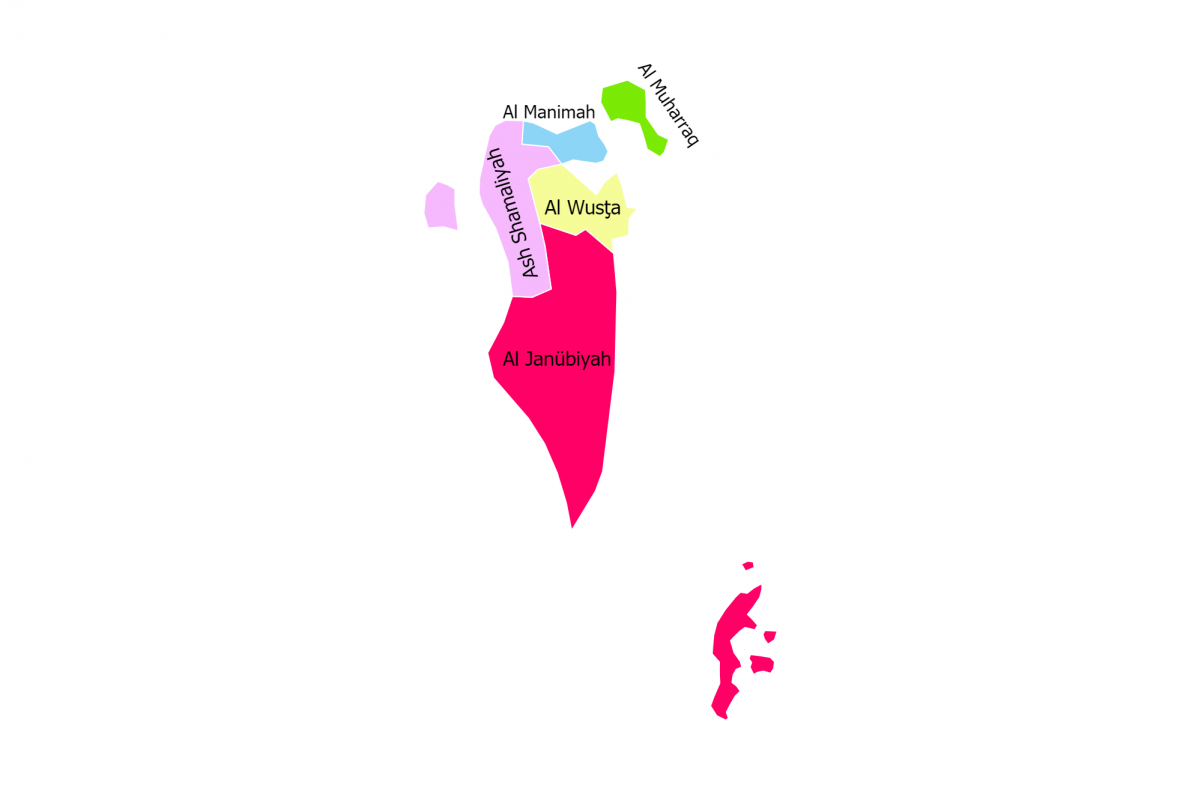

LOCATION:

THE MIDDLE EAST

BORDER COUNTRIES:

IRAN

QATAR

SOUDI ARABIA

ABOUT BAHRAIN

Amongst all the countries in Western Asia, Bahrain, officially the Kingdom of Bahrain, is an island nation located in the Persian Gulf. Comprising an archipelago of 33 islands, Bahrain has a rich history dating back to the ancient Dilmun civilization and has evolved into a dynamic regional financial hub. Known for its progressive regulatory environment, highly skilled workforce, and strategic location, Bahrain is actively diversifying its economy away from oil, focusing on sectors like financial services, ICT, and logistics. Manama is the capital and largest city, serving as the country’s main economic and commercial center. According to the World Bank, Bahrain is classified as a High-Income Economy.

The currency of Bahrain is the Bahraini Dinar (BHD), which is one of the world’s highest-valued currencies. As of today’s exchange rates (June 2025), 1 Bahraini Dinar is approximately 221.73 Indian Rupees. The population of Bahrain is estimated at approximately 1.5 million in 2024, with a significant proportion being expatriates who contribute to its diverse talent pool. Bahrain is connected to Saudi Arabia by the King Fahd Causeway and shares maritime borders with Qatar, Iran, and the United Arab Emirates across the Persian Gulf. The official language is Arabic. English is widely spoken and understood, particularly in business, finance, and among the expatriate community. Islam is the dominant religion, with both Sunni and Shia communities, alongside other faiths practiced by the expatriate population. The main international airport is Bahrain International Airport (BAH). Its key commercial seaport is Khalifa Bin Salman Port (KBSP), a modern facility crucial for trade and logistics in the region.

Bahrain has a highly attractive tax regime. Generally, there is no corporate income tax on profits for most businesses operating in Bahrain, making it a very competitive environment. However, companies operating in the oil and gas sector and those engaged in hydrocarbon exploration and production are subject to specific tax rates (typically 46%). The Bahrain Economic Development Board (EDB) is the primary government agency responsible for attracting and facilitating foreign direct investment. Bahrain offers various investment incentives to promote economic diversification under its Vision 2030, including:

- No Corporate Income Tax (for most sectors).

- No Personal Income Tax.

- 100% Foreign Ownership in most sectors (including manufacturing, tourism, professional services, education, and healthcare).

- Competitive Operating Costs: Lower operating costs compared to some other GCC countries.

- Access to Saudi Market: Direct land access to Saudi Arabia via the King Fahd Causeway.

- Free Zones & Industrial Areas: Benefits such as duty exemptions on raw materials and equipment.

- Skilled Workforce: Access to a multi-skilled, bilingual (Arabic/English) workforce.

- Full Repatriation of Capital and Profits. Opesh Group of companies will be helping you in completing the Due Diligence process which includes financial planning, registration process, business options, and if required, even helping you find a Rental property for your office.

Establishing a business in Bahrain is known for its ease and efficiency, making it one of the most investor-friendly environments in the Gulf region. The Ministry of Industry and Commerce (MoIC) and the Bahrain Economic Development Board (EDB) streamline the registration process. The most common legal structures for foreign investors are a With Limited Liability (W.L.L.) company or a Branch Office. Bahrain’s liberal foreign investment laws generally permit 100% foreign ownership in most sectors, with minimal restrictions. This progressive approach, combined with a robust regulatory framework, positions Bahrain as an ideal hub for businesses looking to access the wider Middle East market.

In case an investor is planning to establish a W.L.L. or a corporate business setup in Bahrain, Opesh Group will be helping you in taking the right decision for setting up your business in Bahrain and we will also guide you about how to follow the procedure while formulating your company in Bahrain.

Types of Business which can be started in Bahrain (aligned with Bahrain Vision 2030):

- Financial Services: A long-established financial hub, with strong growth in FinTech, Islamic finance, digital banking, and asset management.

- Information & Communication Technology (ICT): Opportunities in data centers, cloud computing, cybersecurity, software development, and emerging technologies.

- Manufacturing: Focus on downstream aluminum industries, petrochemicals, food processing, and specialized manufacturing.

- Logistics & Transportation: Leveraging its strategic location and efficient port (Khalifa Bin Salman Port) for regional distribution, warehousing, and logistics services.

- Tourism & Hospitality: Development of leisure facilities, resorts, cultural attractions, and MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism.

- Healthcare: Investment in hospitals, specialized clinics, medical technology, and healthcare services.

- Education & Training: Opportunities in vocational training, higher education, and specialized skill development centers.

- Real Estate & Construction: Supporting the development of new urban areas, commercial projects, and tourism infrastructure.

Advantages of Starting Business in Bahrain:

- Favorable Tax Regime: Generally 0% corporate tax for most businesses, and no personal income tax.

- Lowest Operating Costs: Compared to other GCC countries, offering significant cost advantages.

- 100% Foreign Ownership: Allowed in most sectors, providing full control to foreign investors.

- Skilled & Bilingual Workforce: Access to a well-educated local and expatriate workforce.

- Strategic Gateway: Direct causeway access to Saudi Arabia, and excellent connectivity to the wider Gulf region.

- Pro-Business Environment: Streamlined regulations, supportive government, and robust legal framework.

- Developed Financial Sector: A mature and sophisticated financial services ecosystem.

- High Quality of Life: Attractive destination for expatriates.

Imports & Exports: Bahrain’s economy, while diversifying, still has hydrocarbons and aluminum as its primary exports. Imports are diverse, supporting its industrial base and consumer needs.

Major items which are exported from Bahrain:

- Crude Petroleum & Petroleum Products

- Aluminum (primary and rolled)

- Petrochemicals

- Iron Ore

- Prepared Foodstuffs

- Textiles

Major items which are imported in Bahrain:

- Crude Petroleum (for refining and re-export)

- Machinery and Electrical Equipment

- Vehicles and Transportation Equipment

- Chemical Products

- Food and Live Animals

- Base Metals and Articles thereof

- Pharmaceutical Products

Major items traded between Bahrain and India (as of June 2025): Trade relations between Bahrain and India are strong and growing, covering various sectors.

- Exports from Bahrain to India: Primarily Crude Oil and Petroleum Products, Aluminum, and Chemicals.

- Imports in Bahrain from India: Include Petroleum Products, Iron & Steel, Machinery & Equipment, Cereals (especially Basmati rice), Organic Chemicals, Pharmaceuticals, Textiles, and various food items. Indian professionals and companies have a significant presence in Bahrain’s services and construction sectors.

Manufacturing: Manufacturing is a key sector in Bahrain’s diversification efforts, particularly in energy-intensive industries and those that leverage its strategic location. Key manufacturing industries include:

- Aluminum: Aluminium Bahrain (Alba) is one of the world’s largest aluminum smelters, driving a significant downstream aluminum industry (e.g., aluminum extrusion, cables).

- Petrochemicals & Refined Petroleum Products: Leveraging its oil and gas resources for local refining and petrochemical production.

- Food Processing: A growing sector focused on local production and regional distribution of processed foods.

- Building Materials: Production of cement, glass, and other materials to support construction.

- Metal Fabrication: Supporting various industries, including oil & gas and construction. The government is actively promoting high-value-added manufacturing and attracting technology-intensive industries.

Mining: Bahrain’s natural mineral resources are limited. The “mining” sector is almost entirely focused on the extraction of hydrocarbons, primarily crude oil and natural gas, both onshore and offshore. While there are some activities related to quarrying for construction materials like sand and aggregates, Bahrain does not possess significant non-hydrocarbon mineral deposits. Its economic strength is built on its financial services, logistics, and manufacturing (especially aluminum) sectors, rather than large-scale mineral extraction.

- GDP = $47.34 billion (nominal, 2024 est. IMF)

- GDP Growth = 3.0% (2024 forecast, IMF); 2.9% (2025 forecast, IMF)

- Ease of doing business rank = The World Bank’s ‘Doing Business’ report has been discontinued. In its last edition (2020), Bahrain ranked 43rd globally out of 190 economies, having improved significantly in areas such as starting a business, getting electricity, and trading across borders. The Kingdom continues to implement reforms to further enhance its competitive business environment.

- GDP per Capita = $30,950 (nominal, 2024 est. IMF)

Thanks for reading this Article. Watch our Video and know more about Bahrain. For any Business Enquiry Join Millionaire Program and change everything in life and Business.. Call/ WhatsApp +91- 8094607111.

MOST RECENT VIDEOS

SIGN UP TODAY

Get our exclusive content and offers in your inbox