CURRENCY

BUSINESS OPPORTUNITIES IN LIECHTENSTEIN

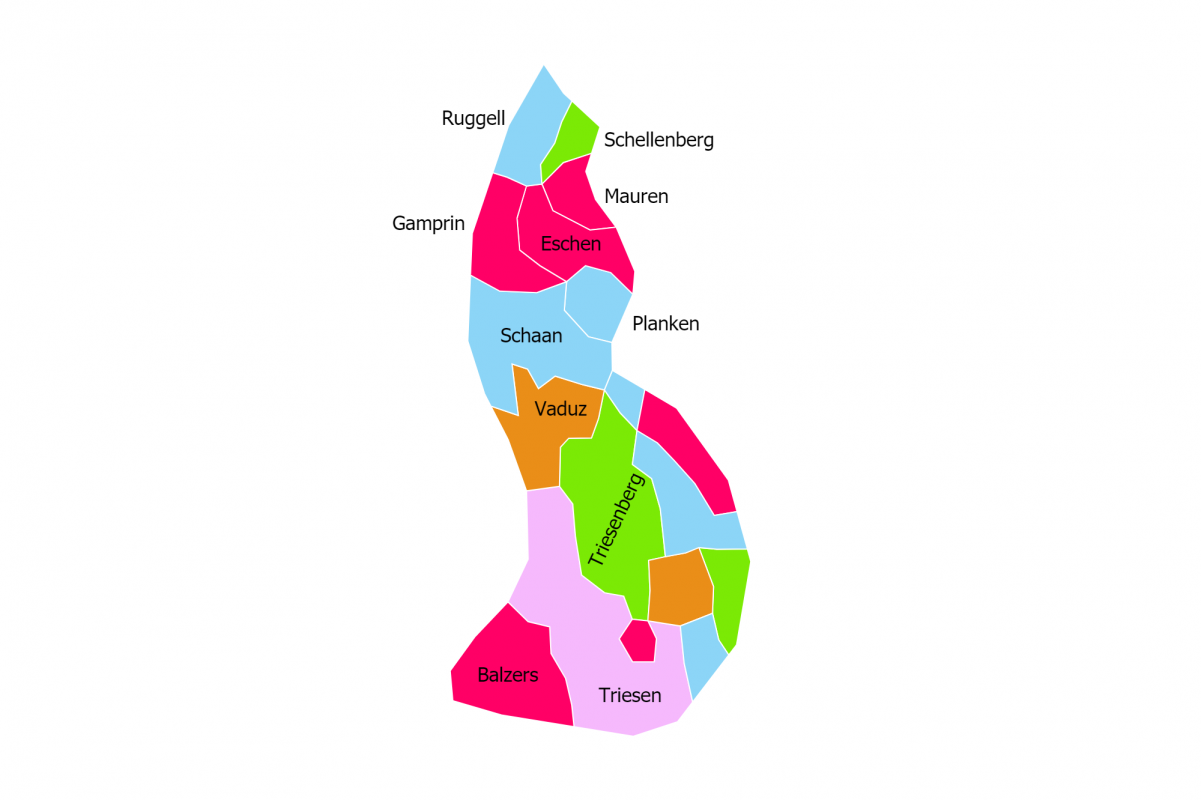

LIECHTENSTEIN

FLAG

LIECHTENSTEIN

CAPITAL CITY

VADUZ

SWISS FRANC

Language

Population

38,246

Country

Calling Code

+423

LOCATION:

EUROPE

BORDER COUNTRIES:

SWITZERLAND

AUSTRIA

LIECHTENSTEIN

ABOUT LIECHTENSTEIN

Amongst all the countries in Europe, Liechtenstein, officially the Principality of Liechtenstein, is a tiny, landlocked microstate nestled in the Alps between Switzerland and Austria. It is a constitutional monarchy known for its picturesque mountainous landscapes, medieval castles, and its status as a highly industrialized, high-tech, and wealthy financial center. The capital of Liechtenstein is Vaduz, which is its financial and administrative hub. According to the report of the World Bank, Liechtenstein is classified as a High-Income Nation, boasting one of the highest GDP per capita in the world. The currency of Liechtenstein is the Swiss Franc (CHF), which it uses due to its customs and monetary union with Switzerland. As of today’s exchange rates (June 2025), 1 Swiss Franc is approximately 93.50 Indian Rupees. The population of Liechtenstein is very small, estimated to be around 40,000 in 2024. Its only neighbouring countries are Switzerland to the west and south, and Austria to the east and north. The official language of the country is German. English is widely understood and spoken, especially in international business and financial sectors, given the country’s global clientele. The majority of the population practices Roman Catholicism, with a significant Protestant minority and other faiths. Currently, Liechtenstein has no international airports within its borders; it relies on nearby international airports in Switzerland (e.g., Zurich Airport, ZRH, approx. 120 km) or Austria (e.g., St. Gallen-Altenrhein Airport, ACH, approx. 40 km) for air travel. As a landlocked country, Liechtenstein has no seaports and relies on the major European ports and rail networks for its international trade requirements.

The standard corporate income tax rate in Liechtenstein is a highly competitive 12.5%. Liechtenstein’s tax system is designed to be attractive for international businesses and individuals, emphasizing a stable and transparent environment. Key incentives include a very favorable tax regime for holding companies and asset management companies, as well as a low effective tax burden for innovative and value-adding businesses. The country’s membership in the European Economic Area (EEA) provides full access to the EU’s single market, despite not being an EU member. Opesh Group of companies will be helping you in the completing Due Diligence process which includes financial planning, registration process, business options, and if required, even helping you find a Rental property for your office.

Establishing a business in Liechtenstein is known for its high level of legal certainty, stability, and efficient administrative processes. The Office for Economic Affairs (Amt für Volkswirtschaft) is the primary governmental body overseeing business registrations and economic development. A foreign investor who is planning to start his business in Liechtenstein can form various company types, with the most common being a Public Limited Company (Aktiengesellschaft or AG), a Private Limited Company (Gesellschaft mit beschränkter Haftung or GmbH), or the unique “Anstalt” (Establishment), which is a very flexible legal entity. The AG and GmbH structures are commonly used, allowing 100% foreign ownership. While there’s no fixed minimum share capital for all entities, an AG typically requires CHF 50,000. Liechtenstein’s legal framework is robust, highly stable, and aligned with international standards, providing a secure and predictable environment for businesses.

In Case an investor is planning to establish an AG or GmbH in Liechtenstein or a corporate business setup, Opesh Group will be helping you in taking the right decision for setting up your business in Liechtenstein and we will also guide you about how to follow the procedure while formulating your company in Liechtenstein.

Types of Business which can be started in Liechtenstein-

- Financial Services: This is the cornerstone of Liechtenstein’s economy. Opportunities are vast in wealth management, asset management, fund administration, private banking, insurance, and trust services, leveraging its stable regulatory environment and discretion.

- High-Tech Manufacturing: Despite its small size, Liechtenstein has a highly specialized and innovative manufacturing sector. Opportunities exist in precision instruments, dental technology, vacuum technology, specialized electronics, and high-quality automotive components.

- Information Technology & Blockchain/DLT: Liechtenstein has been a pioneer in embracing blockchain and Distributed Ledger Technology (DLT) with a clear legal framework. Opportunities are significant in crypto asset management, DLT applications, FinTech solutions, and related IT services.

- Professional Services: Due to the strong financial and corporate sector, there is high demand for specialized legal, accounting, auditing, and tax advisory services for international clients.

- Intellectual Property & Licensing: The stable legal environment and low tax rates make it attractive for holding and licensing intellectual property rights.

Advantages of Starting Business in Liechtenstein-

- Highly Stable & Secure Environment: One of the most politically and economically stable countries globally, offering exceptional legal certainty and low risk.

- Very Low Corporate Tax Rate: The 12.5% corporate income tax rate is highly competitive and attractive for international businesses.

- Access to EU Single Market (via EEA): Membership in the European Economic Area provides full access to the EU’s single market, goods, services, capital, and people.

- Highly Qualified & Multilingual Workforce: A well-educated and productive workforce, with strong proficiency in German and English, especially in the financial and high-tech sectors.

- Strong Financial Center Expertise: Decades of experience in international wealth management and asset protection.

- Innovation-Friendly Regulatory Framework: Especially for emerging technologies like blockchain and DLT, Liechtenstein offers a clear and supportive legal environment.

- Swiss Franc Stability: The use of the stable Swiss Franc currency provides economic predictability.

- Efficient Administration: Streamlined and efficient administrative processes for business setup and operations.

Business Opportunities for Indians in Liechtenstein-

There are excellent business opportunities in Liechtenstein for new investors who are planning to start their business abroad. Liechtenstein’s unique strengths as a highly specialized financial center and a hub for niche high-tech manufacturing and DLT offer distinct avenues for Indian businesses. Indian investors with strengths in IT services (especially FinTech, blockchain development, cybersecurity), financial services (wealth management for high-net-worth individuals, fund administration, investment advisory), specialized manufacturing components, and professional services catering to international clients, can find significant potential for investment, partnerships, and market entry into the European financial and technology ecosystems.

Imports & Exports-

Many goods are imported and exported from Liechtenstein. Imports and exports business is an ever-growing business in any country; however, you need to do proper R&D before investing in that product which you can import or export. You need to check whether that product is suitable for your target market and how much revenue you will be able to generate from that market.

Major items which are exported from Liechtenstein:

- Precision machinery and instruments (e.g., dental products, vacuum technology components)

- Specialized electronic goods

- Ceramics and chemical products

- Food products (e.g., processed foods, wine)

- Pharmaceuticals

Major items which are imported in Liechtenstein:

- Machinery and equipment

- Metal goods

- Textiles

- Foodstuffs

- Motor vehicles and transport equipment

- Energy products

Major items traded between Liechtenstein and India (data is generally very limited due to Liechtenstein’s size and indirect trade via Switzerland/EU):

- Exports from Liechtenstein to India: Precision instruments, specialized machinery, chemicals.

- Imports in Liechtenstein from India: Textiles, pharmaceuticals (likely indirect via larger European distributors).

Manufacturing-

Manufacturing in Liechtenstein is highly specialized and focused on high-value-added products, distinguishing itself through precision engineering, innovation, and quality. Opportunities exist in niche areas such as precision instruments, dental technology, vacuum technology, mechanical engineering, specialized electronics, and automotive components. Liechtenstein’s manufacturers often serve global markets with cutting-edge products.

Mining-

The mining business in Liechtenstein is virtually non-existent. Due to its small size and mountainous terrain, Liechtenstein lacks significant natural mineral resources that would support large-scale commercial mining operations. Its economy is instead built on high-value-added financial services and specialized manufacturing. Therefore, investors looking for opportunities in conventional mining would find no prospects in Liechtenstein.

Major Indian companies which are currently working in Liechtenstein-

Due to its very small size and highly specialized economy, major Indian conglomerates or manufacturing units do not typically have a large-scale direct physical presence in Liechtenstein. Any Indian business presence would likely be through:

- Financial Services: Indian high-net-worth individuals or financial institutions may utilize Liechtenstein’s asset management and wealth protection services, but not necessarily through direct operational offices.

- IT/FinTech Partnerships: Niche Indian IT firms specializing in blockchain or FinTech might engage in partnerships or provide services to Liechtenstein-based financial institutions.

- Trade: Limited trade in specialized products might occur through distributors or partners based in Switzerland or other European countries.

- GDP = $6.2 billion (nominal, 2023 est., note extremely high per capita)

- GDP Growth = 1.6% (2023 actual, economic activity is very stable)

- Ease of doing business rank = The World Bank’s ‘Doing Business’ report has been discontinued. However, Liechtenstein is renowned for its high level of legal certainty, transparent regulatory framework, and business-friendly environment.

- GDP per Capita = $170,000+ (nominal, 2023 est., among the highest globally)

Thanks for reading this Article. Watch our Video and know more about Liechtenstein. For any Business Enquiry Join Millionaire Program and change everything in life and Business.. Call/ WhatsApp +91- 8094607111.

MOST RECENT VIDEOS

SIGN UP TODAY

Get our exclusive content and offers in your inbox