CURRENCY

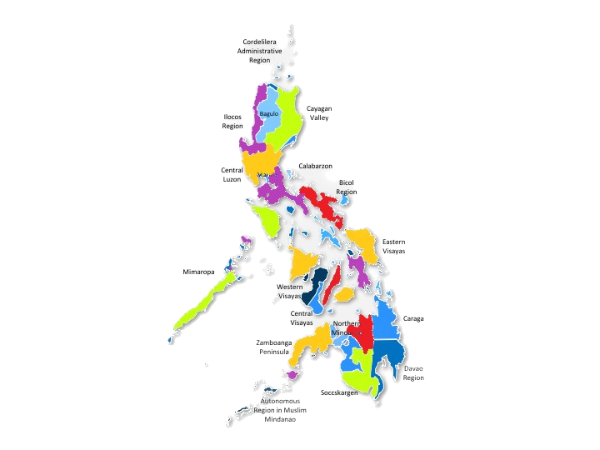

BUSINESS OPPORTUNITIES IN PHILIPPINESS

PHILIPPINESS

FLAG

PHILIPPINESS

CAPITAL CITY

MANILA

PHILIPPINE PESO

Language

Population

11.11 CRORES

Country

Calling Code

+63

LOCATION:

ASIA

BORDER COUNTRIES:

TAIWAN

JAPAN

PALAU

INDONESIA

MALAYSIA

BRUNEI

VIETNAM

THE  MONEY SHOW SEASON 2.0

MONEY SHOW SEASON 2.0

Mining and Infrastructure Business in Algeria

Facebook live 7.00 Pm Today.

Join Millionaire Program and change everything in life and Business..

Call/ WhatsApp +91- 8094607111.

GDP= $402.64 billion

GDP Growth= 6.7%

Ease of doing business rank= 95

GDP per Capita= $3,000

MOST RECENT VIDEOS

SIGN UP TODAY

Get our exclusive content and offers in your inbox