CURRENCY

BUSINESS OPPORTUNITIES IN SIERRA LEONE

SIERRA LEONE

FLAG

SIERRA LEONE

CAPITAL CITY

FREETOWN

SIERRA LEONEAN LEONE

Language

Population

8.14 LAKHS

Country

Calling Code

+232

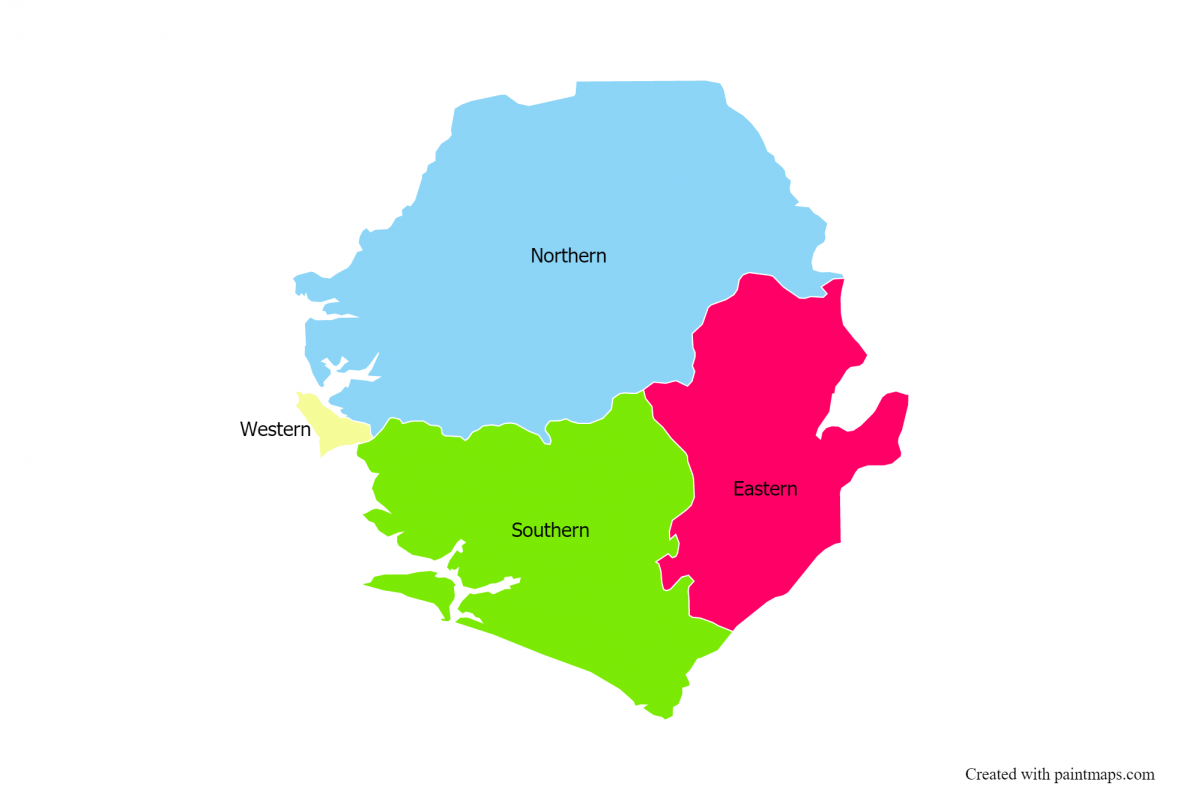

LOCATION:

WEST Africa

BORDER COUNTRIES:

GUINEA

LIBERIA

THE ATLANTIC OCEAN

Start Your Own Business in SIERRA LEONE.

Today I am going to show you, how to Start your own Business in SIERRA LEONE. (One Business Change Everything)

Here’s some advice for you today— WATCH MY VIDEO.

Act Now immediately.

That starts with you and your productivity 👇

✔️ Get a Super Business growth in Diamond Mining/ Industry.

✔️ Get a Super Business Growth in Gold, Iron & Bauxite Mining.

✔️ Hottest Opportunities in International Business.

✔️ Get Benefits of FDI Investment.

✔️ Start International Trading/ Export Base.

✔️ Start Manufacturing Unit without Competition.

✔️ Learn Unlimited Business Opportunity in Sierra Leone.

👉🏻Get a Super Business Growth with Opesh Singh.

visit- www.opeshsingh.com/OpeshStore.

#opesh singh #3bgrowthcon #megha nath #Sierra Leone #international hotels #foreign business ideas #foreign trade #start your business 2020 #success

#how to invest

GDP= $3.91 billion

GDP Growth= 3.7%

Ease of doing business rank= 163

GDP per Capita= $500

MOST RECENT VIDEOS

SIGN UP TODAY

Get our exclusive content and offers in your inbox