CURRENCY

BUSINESS OPPORTUNITIES IN TIMOR-LESTE

TIMOR-LESTE

FLAG

TIMOR-LESTE

CAPITAL CITY

DILI

UNITED STATES DOLLAR

Language

Population

13.45 LAKHS

Country

Calling Code

+670

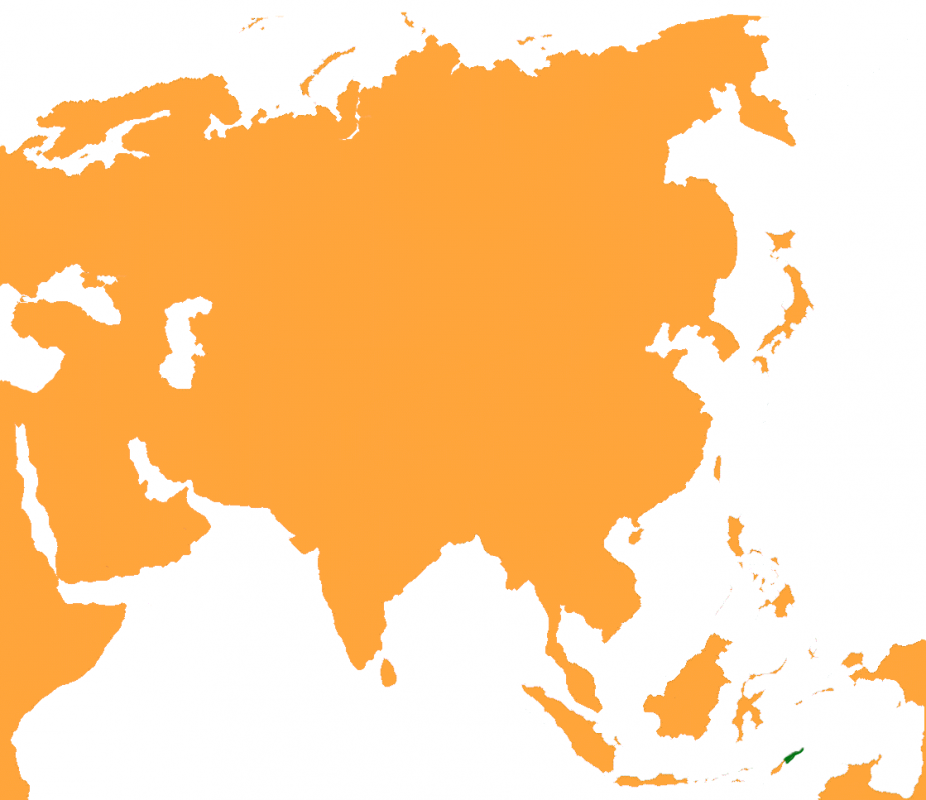

LOCATION:

ASIA

BORDER COUNTRIES:

INDONESIA

THE SAVU SEA

THE TIMOR SEA

AUSTRALIA

ABOUT TIMOR-LESTE

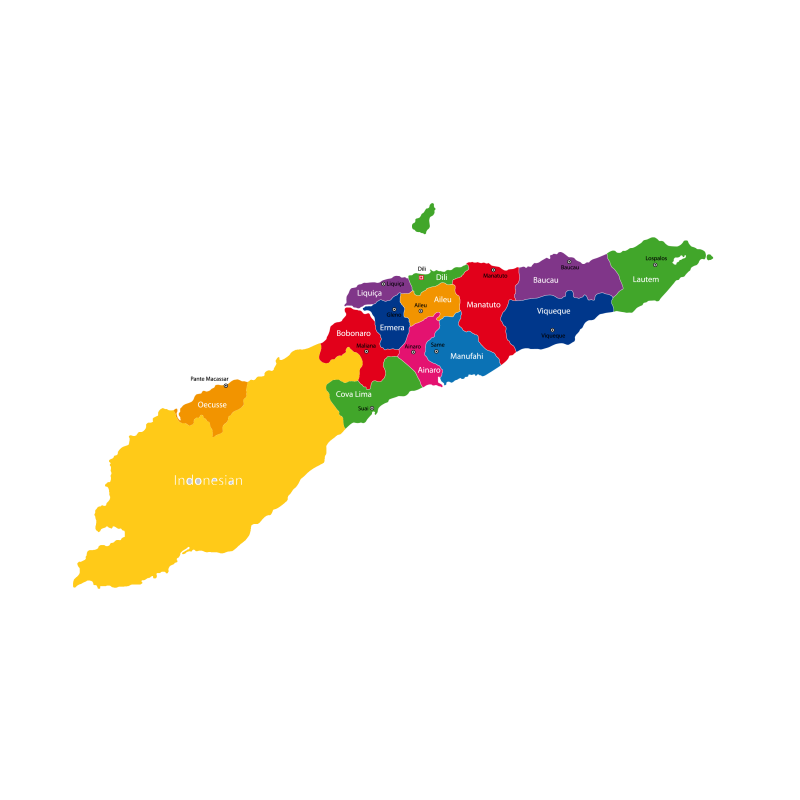

Amongst all the countries in Southeast Asia, Timor-Leste, also known as East Timor, is a young island nation that gained full independence in 2002, making it one of the youngest democracies in Asia. It occupies the eastern half of the island of Timor, along with the nearby islands of Atauro and Jaco. Dili is the capital and largest city, serving as the primary political and economic center. According to the World Bank, Timor-Leste is classified as a Lower-Middle Income Economy, with its economy heavily reliant on revenue from offshore oil and gas reserves, though the country is actively seeking to diversify its economic base.

The currency of Timor-Leste is the United States Dollar (USD), adopted as the official currency to ensure macroeconomic stability. Additionally, it issues its own centavo coins. As of today’s exchange rates (June 2025), 1 US Dollar is approximately 83.56 Indian Rupees. The population of Timor-Leste is estimated at approximately 1.38 million in 2024. Timor-Leste shares a land border with Indonesia (West Timor) to the west. It has maritime borders with Australia to the south and Indonesia to the northwest. The official languages are Tetum and Portuguese. While Portuguese is a legacy of colonial rule, Tetum is the most widely spoken indigenous language. English and Bahasa Indonesia are also understood and used in business and government circles, particularly by younger generations. The majority of the population practices Catholicism, reflecting its Portuguese colonial heritage, with small minorities of Protestantism, Islam, and traditional animist beliefs. The main international airport is Presidente Nicolau Lobato International Airport (DIL) in Dili, which facilitates international air travel. Timor-Leste’s primary commercial seaport is Dili Port, with a newer deep-water port at Tibar Bay operational, crucial for handling increasing trade volumes and improving logistics.

The standard corporate income tax rate in Timor-Leste is 10%. To attract foreign direct investment and stimulate economic diversification, the government offers a range of incentives, primarily through its Agency for Private Investment and Export Promotion (ANIP). These incentives are designed to promote growth in priority sectors. Key incentives can include:

- Tax Holidays: Potential for exemption from corporate income tax for specific periods, depending on the investment value and sector.

- Customs Duty Exemptions: For the import of capital goods, raw materials, and components used in qualifying investment projects.

- Reduced Withholding Taxes: On dividends, interest, and royalties.

- Simplified Licensing and Permitting: Efforts are being made to streamline administrative processes for investors.

- Special Economic Zones (ZEESM TL): The Oecusse-Ambeno Special Economic Zone of Social Market Economy offers enhanced incentives and a distinct regulatory framework.

Opesh Group of companies can assist in the due diligence process which includes financial planning, registration process, business options and if required evening helping you find a Rental property for your office.

Establishing a business in Timor-Leste requires careful consideration of its developing legal and regulatory environment. The most common types of business entities for foreign investors include a Limited Liability Company (Sociedade Limitada, LDA), Sole Proprietorship, or Branch Office. The Foreign Investment Law generally permits 100% foreign ownership in most sectors, aimed at attracting much-needed capital and expertise. However, investors should be prepared for a frontier market environment with potential challenges related to bureaucratic processes, limited infrastructure, and a nascent legal system.

In Case an investor is planning to establish an LDA or a corporate business setup, Opesh Group will be helping you in taking the right decision for setting up your business in Timor-Leste and we will also guide you about how to follow the procedure while formulating your company in Timor-Leste.

Types of Business which can be started in Timor-Leste:

- Oil & Gas: The sector remains the backbone of the economy. While existing fields are maturing, exploration for new reserves and downstream processing (e.g., gas liquefaction) could present opportunities, though significant capital and expertise are required.

- Agriculture: Opportunities exist in developing sustainable practices for traditional crops like coffee and spices, as well as diversifying into food crops to enhance food security and reduce imports.

- Tourism: With stunning natural beauty (beaches, mountains, coral reefs), rich culture, and historical sites, eco-tourism, diving, and cultural tourism have significant untapped potential. Investment in hospitality infrastructure (hotels, resorts) is crucial.

- Fisheries: Blessed with rich marine resources, there is potential for commercial fishing, aquaculture, and seafood processing, currently largely underdeveloped.

- Infrastructure Development: Significant need for investment in roads, bridges, ports (e.g., Tibar Bay expansion), electricity generation and distribution, and digital connectivity to support overall economic development.

- Renewable Energy: Abundant potential in hydro, solar, and wind power to meet growing energy demands and reduce reliance on fossil fuels.

Advantages of Starting Business in Timor-Leste:

- Strategic Location: Proximity to growing Southeast Asian and Australian markets.

- Natural Resources (Oil & Gas): Current revenue base, though diversification is a key goal.

- Untapped Potential: Many sectors like tourism, agriculture, and fisheries are largely underdeveloped.

- Government Focus on Diversification: Strong political will to reduce reliance on oil and gas, creating opportunities in non-oil sectors.

- Young Workforce: A relatively young population, with investments in education and training.

- Use of USD: Provides currency stability and predictability for international transactions.

Imports & Exports: Timor-Leste’s trade balance is heavily influenced by its petroleum sector.

Major items which are exported from Timor-Leste:

- Crude Petroleum and Natural Gas (dominant export, from the Timor Sea)

- Coffee (Arabica coffee is a significant non-oil export)

- Some minor agricultural products and handicrafts

Major items which are imported in Timor-Leste:

- Refined Petroleum Products

- Machinery and Transport Equipment

- Foodstuffs (e.g., rice, sugar, processed foods)

- Construction Materials

- Consumer Goods

- Chemical Products

Major items traded between Timor-Leste and India (as of June 2025): Trade between Timor-Leste and India is currently very limited but has potential for growth, particularly as Timor-Leste diversifies its economy.

- Exports from Timor-Leste to India: Likely very small, possibly some coffee or other agricultural products.

- Imports in Timor-Leste from India: May include pharmaceuticals, some machinery, textiles, and various consumer goods.

Manufacturing: Timor-Leste’s manufacturing sector is very nascent and primarily consists of small-scale activities.

- Food Processing: Basic processing of coffee, rice, and some other agricultural products.

- Beverage Production: Local production of soft drinks and bottled water.

- Construction Materials: Limited production of cement and other basic building materials.

- Handicrafts: Traditional textiles (tais) and other artisanal products. The government is keen to attract investment to develop its manufacturing base for import substitution and value addition.

Mining: The most significant mining activity in Timor-Leste is offshore oil and gas extraction in the Timor Sea.

-

Oil & Gas: Revenues from existing fields (e.g., Bayu-Undan) are crucial for the state budget, though production is declining. Future potential lies in developing new fields (e.g., Greater Sunrise).

-

Onshore Minerals: There is potential for various onshore minerals such as gold, manganese, marble, and limestone, but these are largely unexploited and require significant exploration and investment.

-

GDP = $3.8 billion (nominal, 2024 est. IMF, including petroleum sector)

-

GDP Growth = 2.9% (non-oil GDP, 2024 est. IMF); 3.5% (non-oil GDP, 2025 forecast, IMF)

-

Ease of doing business rank = The World Bank’s ‘Doing Business’ report has been discontinued. In its last edition (2020), Timor-Leste ranked 181st out of 190 economies, indicating a challenging business environment. While reforms are ongoing, significant hurdles remain in areas like starting a business, getting electricity, and enforcing contracts.

-

GDP per Capita = $2,760 (nominal, 2024 est. IMF, including petroleum sector)

Thanks for reading this Article. Watch our Video and know more about Timor-Leste. For any Business Enquiry Join Millionaire Program and change everything in life and Business.. Call/WhatsApp +91- 8094607111.

MOST RECENT VIDEOS

SIGN UP TODAY

Get our exclusive content and offers in your inbox