CURRENCY

BUSINESS OPPORTUNITIES IN UNITED ARAB EMIRATES

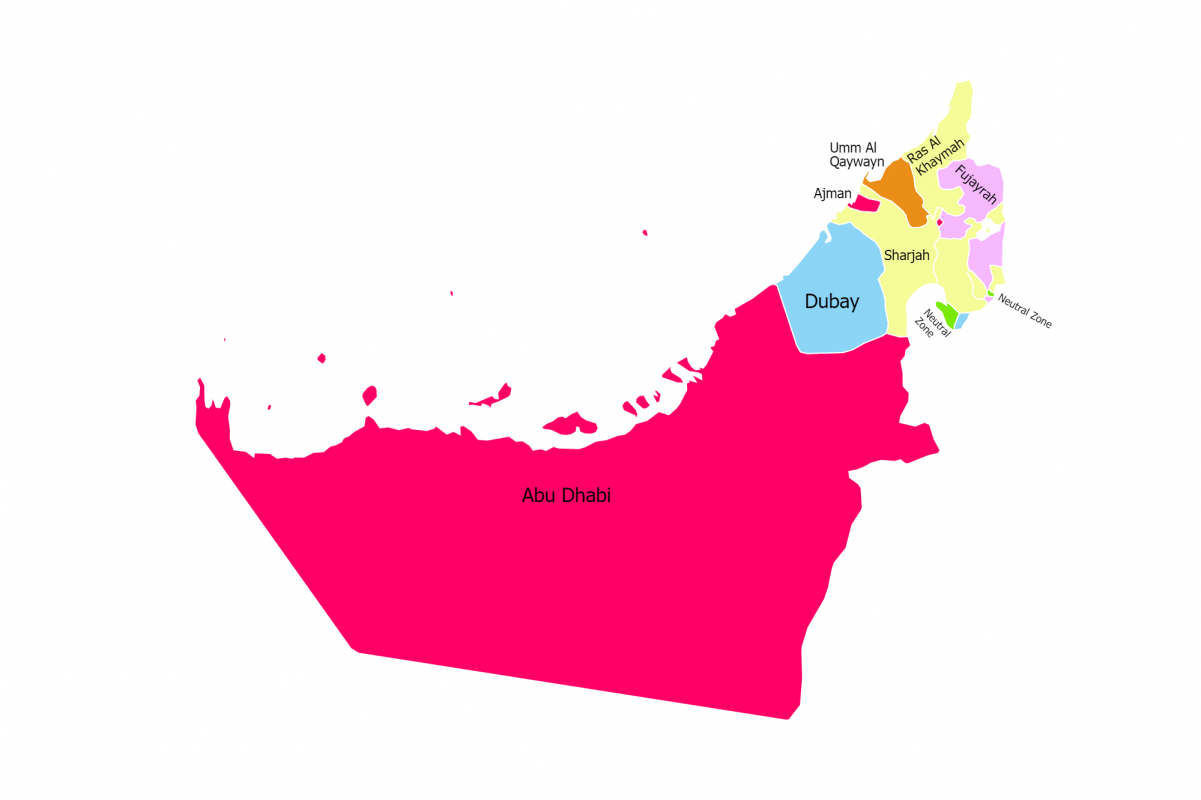

UNITED ARAB EMIRATES

FLAG

UNITED ARAB EMIRATES

CAPITAL CITY

ABU DHABI

DIRHAM

Language

Population

1.002 CRORES

Country

Calling Code

+971

LOCATION:

THE MIDDLE EAST

BORDER COUNTRIES:

SAUDI ARABIA

OMAN

QATAR

ABOUT UNITED ARAB EMIRATES

Amongst all the countries in Western Asia, the United Arab Emirates (UAE) is a federation of seven emirates that has rapidly transformed from a collection of Trucial States into a global economic, tourism, and financial powerhouse. Known for its visionary leadership, iconic skylines, and world-class infrastructure, the UAE is a vibrant hub for international business and culture. Abu Dhabi is the capital, serving as the seat of government and a major oil producer, while Dubai is the largest city and a globally recognized center for trade, tourism, and innovation. The World Bank classifies the UAE as a High-Income Economy, reflecting its strong economic development and high GDP per capita.

The currency of the UAE is the UAE Dirham (AED), which is pegged to the US Dollar, providing stability for international transactions. As of today’s exchange rates (June 2025), 1 UAE Dirham is approximately 23.35 Indian Rupees. The population of the UAE is estimated at approximately 11.03 million in 2024, with a significant majority being expatriates. The UAE shares land borders with Saudi Arabia to the west and south, and Oman to the east. It has extensive maritime borders along the Persian Gulf, bordering Qatar and Iran, and also along the Gulf of Oman and Arabian Sea, with maritime boundaries extending towards Oman. The official language is Arabic, but English is very widely spoken and is the primary language of business and daily communication due to the large expatriate population. While Islam is the official religion, the UAE promotes religious tolerance, and significant expatriate communities practice other faiths. Major international airports include Dubai International Airport (DXB), Abu Dhabi International Airport (AUH), and Sharjah International Airport (SHJ), offering extensive global connectivity. The UAE also boasts some of the world’s busiest commercial seaports, including Jebel Ali Port in Dubai, Khalifa Port in Abu Dhabi, and the Port of Fujairah on the Gulf of Oman, facilitating global trade and logistics.

The UAE introduced a federal corporate income tax (CT) from June 2023, with a standard rate of 9% for taxable profits exceeding AED 375,000. However, businesses operating within the numerous Free Zones can benefit from a 0% corporate tax rate, provided they meet specific criteria and do not conduct business directly on the mainland. The UAE offers a highly attractive investment environment with robust incentives designed to draw foreign direct investment (FDI). These incentives are managed by various government entities, including the Ministry of Economy and various Free Zone authorities. Key incentives include:

- Zero Personal Income Tax: No income tax on salaries and wages for individuals.

- Free Zones: Over 40 Free Zones offering 100% foreign ownership, 0% corporate and personal income tax, 100% repatriation of capital and profits, and exemption from customs duties.

- 100% Foreign Ownership on Mainland: Recent amendments to the Commercial Companies Law (2021) abolished the requirement for a local sponsor for many mainland business activities, allowing 100% foreign ownership in a wide range of sectors.

- Strategic Industry Incentives: Specific benefits for investments in sectors like advanced technology, renewable energy, manufacturing, and healthcare.

- Long-Term Residence Visas: Attractive visa schemes (e.g., Golden Visa) for investors, entrepreneurs, and professionals.

- Robust Infrastructure: World-class connectivity via airports, seaports, and digital networks.

Opesh Group of companies can assist in the due diligence process, including financial planning, company registration (both mainland and Free Zone), exploring optimal business structures, and helping you find suitable office or residential properties.

Establishing a business in the UAE offers various legal structures, with the most common for foreign investors being a Limited Liability Company (LLC) on the mainland, a Free Zone Company, or a Branch/Representative Office. The recent legislative changes allowing 100% foreign ownership for many mainland companies have significantly simplified the setup process and enhanced operational control for international businesses. The UAE’s business environment is highly competitive, transparent, and driven by government initiatives to foster innovation and ease of doing business.

In case an investor is planning to establish an LLC, a Free Zone Company, or any corporate business setup in the UAE, Opesh Group will provide expert guidance to ensure you make the right decisions for your business setup and navigate the registration and compliance procedures efficiently.

Types of Business which can be started in the United Arab Emirates:

- Trade & Logistics: Leveraging its strategic location and world-class ports (Jebel Ali, Khalifa Port) and airports (DXB, AUH), the UAE is a major re-export and logistics hub. Opportunities exist in supply chain management, warehousing, and e-commerce logistics.

- Tourism & Hospitality: A global leader in tourism, with continuous development of hotels, resorts, theme parks, and entertainment venues. Opportunities in luxury tourism, medical tourism, and MICE (Meetings, Incentives, Conferences, Exhibitions).

- Financial Services: A thriving regional financial hub with free zones like DIFC and ADGM, attracting fintech, banking, asset management, and insurance companies.

- Real Estate & Property Development: Continuous development of residential, commercial, and mixed-use projects, including iconic skyscrapers and master-planned communities.

- Information & Communication Technology (ICT) & Digital Economy: Strong government focus on AI, blockchain, cybersecurity, smart cities, and e-commerce platforms. Opportunities in tech startups, software development, and digital services.

- Renewable Energy: Ambitious targets for clean energy, with major projects in solar power (e.g., Mohammed bin Rashid Al Maktoum Solar Park) and green hydrogen. Opportunities in renewable energy production, technology, and services.

- Healthcare & Pharmaceuticals: Growing demand for specialized medical services, hospitals, clinics, and pharmaceutical manufacturing to cater to a diverse and growing population.

- Advanced Manufacturing: Focus on diversifying from traditional oil and gas to high-tech manufacturing, including aerospace, defense, food processing, and specialized industrial goods.

- Aerospace & Space: Investment in aerospace manufacturing, MRO (Maintenance, Repair, and Overhaul) services, and an ambitious national space program.

Advantages of Starting Business in the United Arab Emirates:

- Strategic Global Hub: Central location connecting East and West, with world-class logistics.

- Tax Efficiency: 0% personal income tax and competitive corporate tax, especially in Free Zones.

- Investor-Friendly Policies: 100% foreign ownership now widely available, strong legal framework, and ease of business setup.

- Political and Economic Stability: A stable and secure environment for investment.

- Diversified Economy: Reduced reliance on oil, with strong growth in non-oil sectors.

- Advanced Infrastructure: Modern transportation networks, communication systems, and utilities.

- High Purchasing Power: Affluent local population and high-income expatriate community.

- Access to Talent: Attracts a diverse and skilled international workforce.

Imports & Exports: The UAE is a significant global trading nation, known for its extensive re-export activities and strong links to global supply chains.

Major items which are exported from the United Arab Emirates:

- Crude Petroleum and Natural Gas

- Refined Petroleum Products

- Diamonds (rough and cut)

- Gold (non-monetary)

- Jewelry

- Aluminum

- Machinery and Transport Equipment (re-exports)

- Pearls and Precious Stones (re-exports)

Major items which are imported in the United Arab Emirates:

- Gold (for refining and re-export)

- Machinery and Electrical Equipment

- Vehicles

- Diamonds and Precious Stones

- Foodstuffs

- Base Metals

- Chemical Products

Major items traded between the United Arab Emirates and India (as of June 2025): India and the UAE are strategic partners with robust trade relations, facilitated by the Comprehensive Economic Partnership Agreement (CEPA).

- Exports from the UAE to India: Include crude oil, petroleum products, gold, diamonds, precious stones, machinery, and aluminum.

- Imports in the UAE from India: Comprise precious stones and jewelry, machinery and equipment, textiles, agricultural products (e.g., rice, fruits, vegetables), pharmaceuticals, and IT services.

Manufacturing: The UAE’s manufacturing sector is diversifying beyond hydrocarbons, with a growing focus on high-value and advanced manufacturing.

- Oil & Gas Related Manufacturing: Includes petroleum refining, petrochemicals (e.g., plastics, fertilizers), and gas processing.

- Aluminum Production: Emirates Global Aluminium (EGA) is a major player, making the UAE one of the world’s largest aluminum producers.

- Metals and Basic Industries: Production of steel, cement, and other construction materials.

- Food and Beverage Processing: Growing sector focused on import substitution and enhancing food security.

- Aerospace Manufacturing: Emerging sector with investments in aircraft components and MRO.

- Advanced Manufacturing: Focus on industrial automation, 3D printing, and smart manufacturing technologies in specialized zones.

Mining: The UAE’s mining sector is almost exclusively dominated by the extraction of hydrocarbons.

-

Crude Oil: Possesses significant crude oil reserves, primarily in Abu Dhabi.

-

Natural Gas: Holds substantial natural gas reserves, crucial for domestic energy needs and petrochemical industries.

-

Industrial Minerals: Limited extraction of industrial minerals such as limestone, aggregates, and gypsum, primarily for the domestic construction industry.

-

GDP = $527.8 billion (nominal, 2024 est. IMF)

-

GDP Growth = 3.5% (2024 est. IMF); 4.2% (2025 forecast, IMF)

-

Ease of doing business rank = The World Bank’s ‘Doing Business’ report has been discontinued. In its last edition (2020), the UAE ranked 16th globally out of 190 economies, reflecting its highly favorable and continuously improving business environment.

-

GDP per Capita = $53,916 (nominal, 2024 est. IMF)

Thanks for reading this Article. Watch our Video and know more about the United Arab Emirates. For any Business Enquiry Join Millionaire Program and change everything in life and Business.. Call/WhatsApp +91- 8094607111.

MOST RECENT VIDEOS

SIGN UP TODAY

Get our exclusive content and offers in your inbox